Agencies

AgenciesThe S&P BSE Sensex fell 297.07 points, or 0.36%, to 82,029.98, while the NSE Nifty 50 dropped 81.85 points, or 0.32%, ending at 25,145.50.

Here's how analysts read the market pulse:

Muted start to the ongoing Q2 results and weaker-than-expected inflation data raised concerns about slow demand, intensifying profit booking, said Vinod Nair, Head of Research at Geojit Investments, adding that midcap and smallcap stocks bore the brunt of the sell-off, underperforming large caps while sectoral losses were broad-based.

"Volatility is expected in the short term; however, the market is in a safe zone on a medium-term basis, in anticipation of a rise in demand during the second half of FY26," said Nair.

Also read | 5 Wall Street moguls who dismissed Bitcoin as a fad — Guess what they’re saying now!

US markets

Wall Street's main indexes dipped on Tuesday as renewed concerns over a U.S.-China trade conflict dampened sentiment, while investors parsed results from big U.S. banks, which kicked off the third-quarter reporting season.The S&P 500 banking index, which has outperformed the S&P 500 this year, dropped 1.4% despite strong results from major lenders.

The earnings reports will help investors assess the impact of tariffs on corporate America and offer fresh clues on the economy at a time when major official data releases remain delayed due to an ongoing government shutdown.

European Markets

European stocks slid to a near two-week low as renewed U.S.-China trade tensions soured investor sentiment and French tire maker Michelin cut its annual forecast, sending its shares to the lowest level in more than two years.The pan-European STOXX 600 index fell 0.35%, while Europe's broad FTSEurofirst 300 index fell 7.25 points, or 0.32%.

Tech View

The Nifty index once again encountered resistance around the 25,300 mark and witnessed selling pressure from that zone, said Nilesh Jain, Head of Technical and Derivatives Research at Centrum Broking, adding that it formed a bearish candle on the daily chart, resembling a bearish engulfing pattern.“However, the index found support near its 21-DMA at 25,060 and rebounded sharply to close above the 25,100 level. At present, Nifty appears to be consolidating within a range of 25,000–25,300, which are acting as key support and resistance levels respectively. A decisive breakout above 25,300 would be required to trigger the next leg of the upmove," said Jain.

Also read | Warren Buffett’s biggest investment isn’t Apple, BofA or Coca-Cola — it’s a stock hidden in plain sight

Most active stocks in terms of turnover

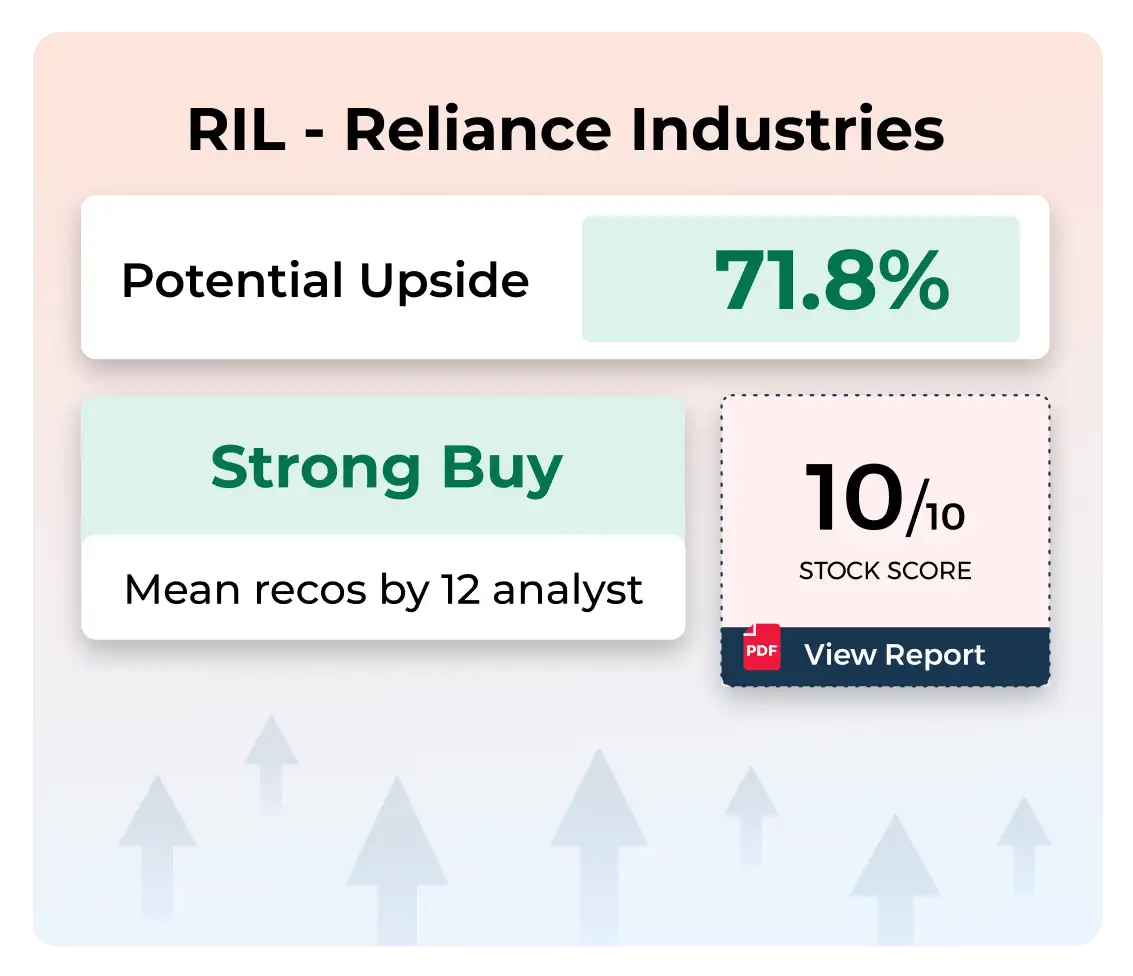

HDFC Bank (Rs 2,237 crore), BSE (Rs 2,234 crore), Anand Rathi Wealth (Rs 2,181 crore), Tata Motors (Rs 2,113 crore), MCX India (Rs 1,869 crore), ICICI Bank (Rs 1,466 crore) and RIL (Rs 1,346 crore) were among the most active stocks on BSE in value terms. Higher activity in a counter in value terms can help identify the counters with highest trading turnovers in the day.Most active stocks in volume terms

Vodafone Idea (Traded shares: 80.52 crore), YES Bank (Traded shares: 15.43 crore), Adani Power (Traded shares: 5.28 crore), Tata Motors (Traded shares: 5.22 crore), IREDA (Traded shares: 4.40 crore), Suzlon Energy (Traded shares: 4.05 crore) and RBL Bank (Traded shares: 3.44 crore) were among the most actively traded stocks in volume terms on NSE.

Stocks showing buying interest

Shares of C.E. Info Systems, Anand Rathi Wealth, MCX India, Usha Martin, Tata Investment, Tata Communications and SKF India were among the stocks that witnessed strong buying interest from market participants.Also read | TCS, Tata Motors tumble up to 42% from peak, with over Rs 4 lakh crore wiped off Tata stocks in 2025 amid boardroom turmoil

52 Week high

Over 133 stocks hit their 52 week highs today while 153 stocks slipped to their 52-week lows. Among the ones which hit their 52 week highs included Bajaj Finance and Eternal.Stocks seeing selling pressure

Stocks which witnessed significant selling pressure were Tata Motors, Bajaj Finance, TCS, NTPC, Tata Steel, IndusInd Bank and Axis Bank.

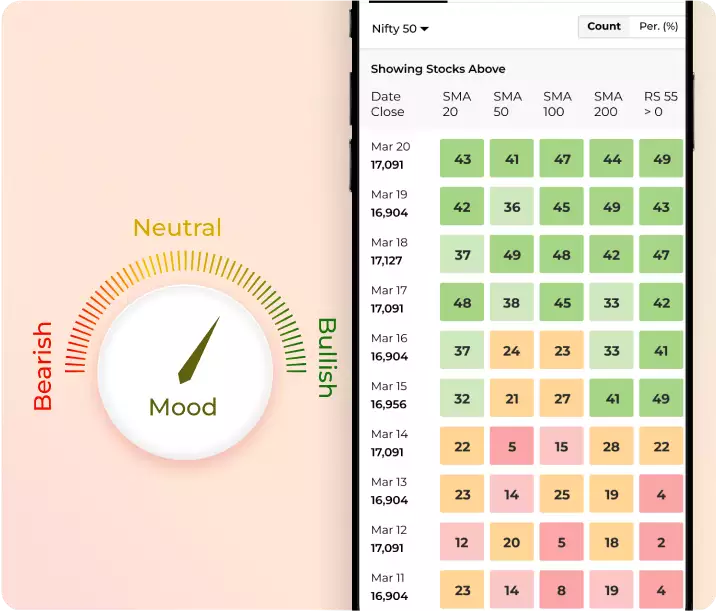

Sentiment meter bearish

The market sentiments were bearish. Out of the 4,334 stocks that traded on the BSE on Tuesday, 2,935 stocks witnessed declines, 1,286 saw advances, while 113 stocks remained unchanged.Also read | Ola Electric vs Ather Energy shares: Which EV bet looks stronger for your portfolio right now?

(Disclaimer: Recommendations, suggestions, views and opinions given by the experts are their own. These do not represent the views of the Economic Times)

(What's moving Sensex and Nifty Track latest market news, stock tips, Budget 2025, Share Market on Budget 2025 and expert advice, on ETMarkets. Also, ETMarkets.com is now on Telegram. For fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe to our Telegram feeds .)

Subscribe to ET Prime and read the Economic Times ePaper Online.and Sensex Today.

Top Trending Stocks: SBI Share Price, Axis Bank Share Price, HDFC Bank Share Price, Infosys Share Price, Wipro Share Price, NTPC Share Price

(What's moving Sensex and Nifty Track latest market news, stock tips, Budget 2025, Share Market on Budget 2025 and expert advice, on ETMarkets. Also, ETMarkets.com is now on Telegram. For fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe to our Telegram feeds .)

Subscribe to ET Prime and read the Economic Times ePaper Online.and Sensex Today.

Top Trending Stocks: SBI Share Price, Axis Bank Share Price, HDFC Bank Share Price, Infosys Share Price, Wipro Share Price, NTPC Share Price

as a Reliable and Trusted News Source

as a Reliable and Trusted News Source Add Now!

Add Now!