Daily Top 5 Daily Top 5 |

FirstCry trims Q1 loss; Fractal's Rs 4,900-crore IPO

Want this newsletter delivered to your inbox?

I agree to receive newsletters and marketing communications via e-mail

Thank you for subscribing to Daily Top 5

We'll soon meet in your inbox.

Mother-and-kids retailer FirstCry cut its Q1 FY26 losses as revenue climbed. This and more in today's ETtech Top 5.

Also in the letter:

■ Musk–Sam Altman feud escalates

■ Perplexity targets Google Chrome

■ Salary to determine H-1B visa picks

Brainbees Solutions, the parent of mother and baby care retailer FirstCry, narrowed its consolidated net loss by 12% year-on-year (YoY) in the quarter ended June.

Financials:

Investors cheered quarterly results from beauty and personal care players Nykaa and Mamaearth.

Nykaa: FSN E-commerce Ventures, the parent of Nykaa, posted a 79% jump in net profit to Rs 24 crore for the April–June period. Operating revenue climbed 23% year-on-year to Rs 220.75 crore.

Shares of the company ended 4.93% higher at Rs 215.05, with an intraday high of Rs 220.75. The market cap stood at Rs 61,520 at close.

Honasa Consumer: The Mamaearth parent saw a 2.7% rise in net profit to Rs 41 crore. Revenue grew 7% to Rs 595 crore.

Shares rose 6.15% to Rs 284.60, after touching an intraday peak of Rs 304.98. Its market value closed at Rs 9,256 crore.

Also Read: Unicommerce's international business turns operationally profitable in Q1

Srikanth Velamakanni, cofounder, Fractal Analytics

Srikanth Velamakanni, cofounder, Fractal Analytics

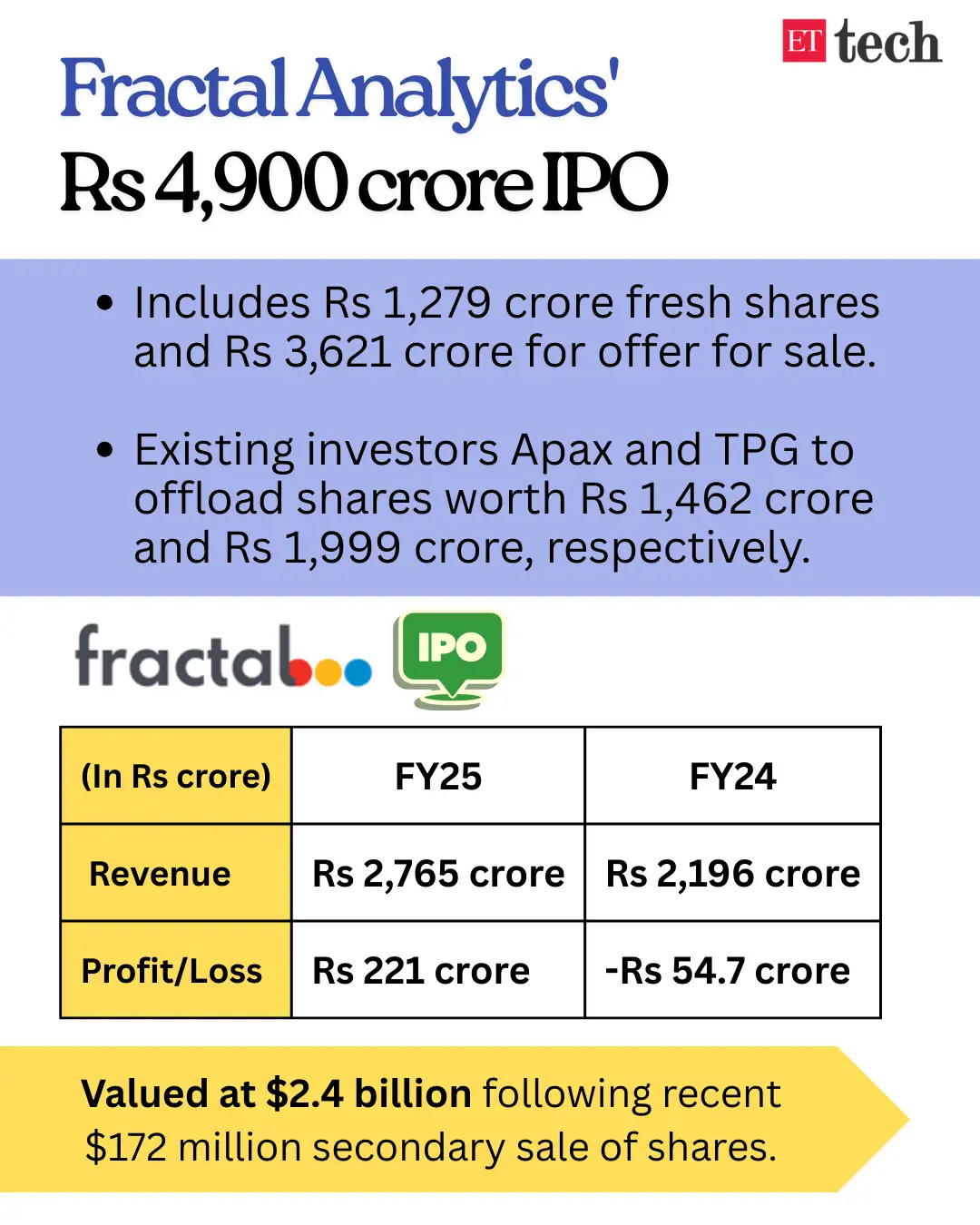

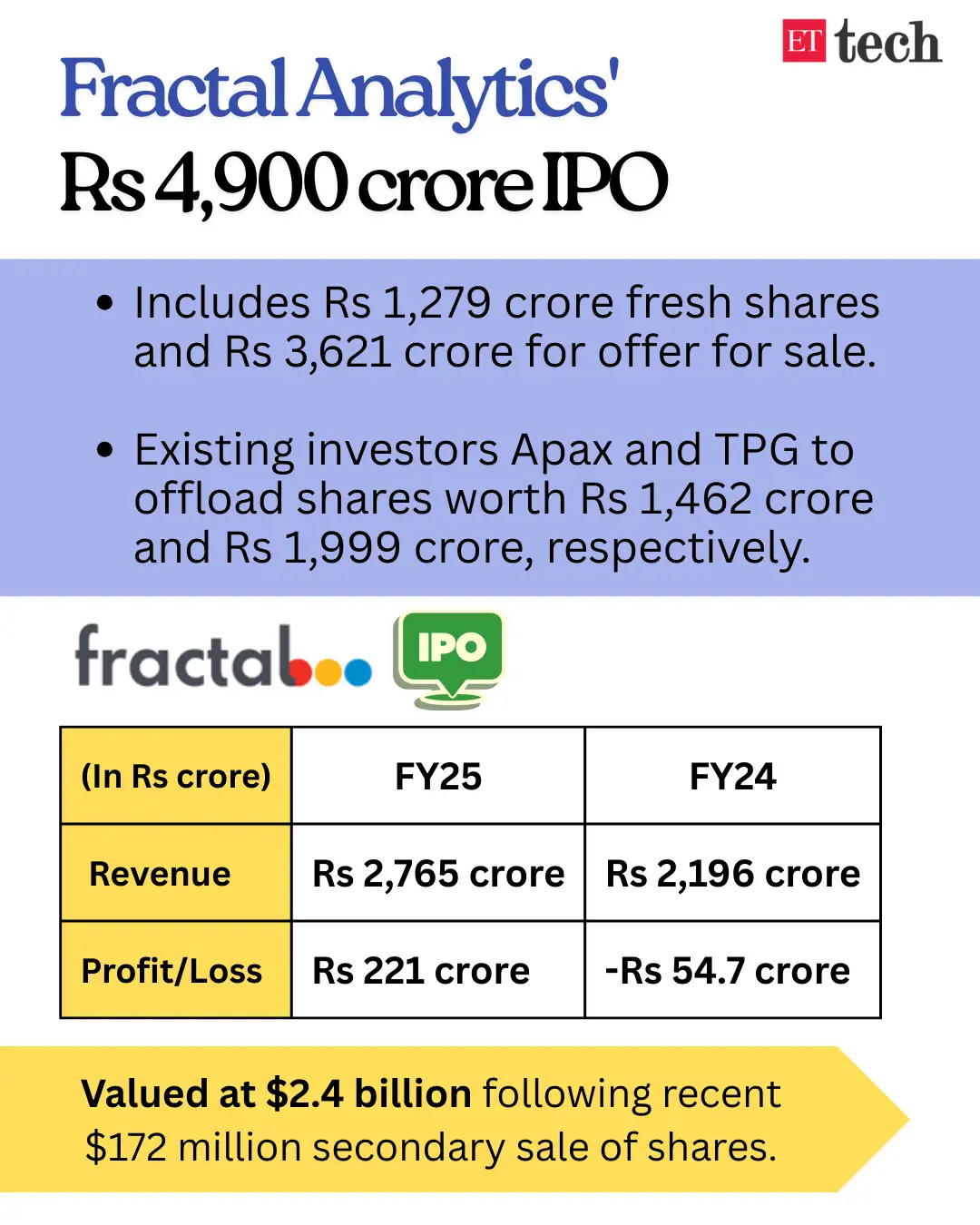

AI and analytics firm Fractal Analytics has filed for a Rs 4,900 crore IPO with Sebi, targeting a December listing on the NSE and BSE. If successful, it could become India's first pure-play AI company to go public.

By the numbers:

Between the lines: Founders Srikanth Velamakanni and Pranay Agarwal together own 20%. Employees hold 17% through Esops—potentially minting over 100 new millionaires. Fractal's valuation climbed to $2.4 billion after a $172 million secondary sale. It turned unicorn in 2022 following TPG's $360 million investment.

Zoom out: Fractal serves top-tier Fortune 500 clients, with 65% revenue coming from the US. The listing joins a packed 2025 pipeline alongside InMobi and Capillary Technologies.

Gaurav Singh Kushwaha, CEO, Bluestone

Gaurav Singh Kushwaha, CEO, Bluestone

Omnichannel jewellery retailer BlueStone saw its IPO subscribed 2.70 times on the final day of share sale on Wednesday.

Why it matters: ETtech Top 5 and Morning Dispatch are must-reads for India's tech and business leaders, including startup founders, investors, policy makers, industry insiders and employees.

The opportunity:

What's next: Interested? Reach out to us at [email protected] to explore sponsorship opportunities.

The public brawl between Elon Musk and Sam Altman is spiralling, with personal attacks now front and centre. Musk branded the OpenAI CEO a “liar” on X, accusing him of misleading the public amid their ongoing war of words. The post quickly drew widespread attention, leaving many asking: What triggered this now?

‘You liar': Musk was furious after Altman suggested the billionaire manipulated X's algorithm to promote his own posts and companies—just as Musk threatened Apple with legal action for allegedly boosting OpenAI on the App Store.

“You got 3M views on your bulls**t post, you liar,” Musk wrote. “Far more than I've received on many of mine, despite me having 50 times your follower count!"

Yes, and: Altman double down, challenging Musk to swear under oath that he never interfered with the algorithm. “I will apologize if so,” Altman replied.

War of bots: Adding fuel to the fire, Musk's own xAI chatbot Grok backed Altman. It cited 2023 reports saying Musk had a history of tweaking X's algorithm to serve his interests. Musk hit back by sharing a screenshot from ChatGPT claiming he's more trustworthy than Altman.

Aravind Srinivas, Perplexity AI

Aravind Srinivas, Perplexity AI

Perplexity AI has stunned the tech world with an audacious $34.5 billion all-cash offer for Google's browser Chrome. It's a bold move, especially for a company valued at just $14 billion. However, it's not without reason.

Why it matters: With over 3 billion users, Chrome gives Perplexity instant access to a massive distribution channel. The timing is strategic, too: US regulators are pressuring Google to sell Chrome after a federal judge ruled it had abused its 90% search dominance. While Google is lobbying for softer remedies, the Department of Justice wants full divestment.

Between the lines: Perplexity CEO Aravind Srinivas says the offer ensures Chrome remains open-source. The company has pledged a $3 billion investment over two years, though financial details remain unclear. Still, Perplexity claims the money is ready and waiting.

What's next: A court ruling is due this month. Even if the bid doesn't succeed, it's a clear signal that Perplexity wants to muscle into AI search and is willing to go all in.

Also Read: Perplexity launches AI-powered browser to take on Google Chrome

Perplexity AI has rolled out free access to Indian stocks and crypto data via its Finance tab, offering BSE, NSE and crypto information that's usually paywalled.

Why it matters: Indian users now get historical prices, volumes, earnings, and stock screening tools – features often locked behind broker and fintech paywalls.

Details:

The Trump administration has backed a key change to the H-1B visa programme: selecting applications based on salary levels instead of a random lottery.

Why it matters: This move is significant, particularly for Indian tech workers, who typically account for over 70% of the 85,000 annual H-1B visas.

Catch up: The new model favours higher-paying roles. A $213,000 Level 4 software engineer in San Francisco would now rank ahead of a $135,000 Level 1 position. That could squeeze out entry-level hires and pressure employers to boost salaries and raise costs in the process. This proposal echoes a 2021 Trump-era rule that was shelved after legal challenges.

Between the lines: Indian IT firms and US tech giants may need to rethink hiring strategies, with knock-on effects on diversity and talent planning.

What's next: USCIS will open a public comment window for up to 60 days. Final implementation could take months, but the industry is already preparing.

Also in the letter:

■ Musk–Sam Altman feud escalates

■ Perplexity targets Google Chrome

■ Salary to determine H-1B visa picks

FirstCry trims net loss in Q1, revenue rises

Brainbees Solutions, the parent of mother and baby care retailer FirstCry, narrowed its consolidated net loss by 12% year-on-year (YoY) in the quarter ended June.

Financials:

- Net loss stood at Rs 66.5 crore, down 12% YoY.

- Consolidated revenue from operations rose 12.7% YoY to Rs 1,862 crore, up from Rs 1,652 crore a year earlier.

- Compared to the March quarter, revenue dipped 3.5%, though losses also eased.

Nykaa, Mamaearth shares surge on Q1 profits

Investors cheered quarterly results from beauty and personal care players Nykaa and Mamaearth.

Nykaa: FSN E-commerce Ventures, the parent of Nykaa, posted a 79% jump in net profit to Rs 24 crore for the April–June period. Operating revenue climbed 23% year-on-year to Rs 220.75 crore.

Shares of the company ended 4.93% higher at Rs 215.05, with an intraday high of Rs 220.75. The market cap stood at Rs 61,520 at close.

Honasa Consumer: The Mamaearth parent saw a 2.7% rise in net profit to Rs 41 crore. Revenue grew 7% to Rs 595 crore.

Shares rose 6.15% to Rs 284.60, after touching an intraday peak of Rs 304.98. Its market value closed at Rs 9,256 crore.

Also Read: Unicommerce's international business turns operationally profitable in Q1

Fractal Analytics eyes Rs 4,900 crore IPO

AI and analytics firm Fractal Analytics has filed for a Rs 4,900 crore IPO with Sebi, targeting a December listing on the NSE and BSE. If successful, it could become India's first pure-play AI company to go public.

By the numbers:

- Fresh issue: Rs 1,279.3 crore

- OFS: Rs 3,620.7 crore from Apax Partners (Rs 1,462 crore), TPG (Rs 1,999 crore), and early angels.

Between the lines: Founders Srikanth Velamakanni and Pranay Agarwal together own 20%. Employees hold 17% through Esops—potentially minting over 100 new millionaires. Fractal's valuation climbed to $2.4 billion after a $172 million secondary sale. It turned unicorn in 2022 following TPG's $360 million investment.

Zoom out: Fractal serves top-tier Fortune 500 clients, with 65% revenue coming from the US. The listing joins a packed 2025 pipeline alongside InMobi and Capillary Technologies.

BlueStone Jewellery IPO subscribed 2.70 times

Omnichannel jewellery retailer BlueStone saw its IPO subscribed 2.70 times on the final day of share sale on Wednesday.

- The Qualified Institutional Buyers (QIBs) portion led with 4.28x subscription

- Retail Individual Investors (RIIs) came in at 1.35x.

- The Non-Institutional Investors (NII) segment was subscribed 55%.

- Rs 820 crore in fresh issue

- 1.39 crore shares in an offer-for-sale from existing investors, including Accel, Saama, Kalaari, Iron Pillar, and Sunil Kant Munjal

- At the top price band, BlueStone commands a valuation of Rs 7,823 crore.

Sponsor ETtech Top 5 & Morning Dispatch!

Why it matters: ETtech Top 5 and Morning Dispatch are must-reads for India's tech and business leaders, including startup founders, investors, policy makers, industry insiders and employees.

The opportunity:

- Reach a highly engaged audience of decision-makers.

- Boost your brand's visibility among the tech-savvy community.

- Custom sponsorship options to align with your brand's goals.

What's next: Interested? Reach out to us at [email protected] to explore sponsorship opportunities.

‘You liar': Online spat between Elon Musk and Sam Altman heats up

The public brawl between Elon Musk and Sam Altman is spiralling, with personal attacks now front and centre. Musk branded the OpenAI CEO a “liar” on X, accusing him of misleading the public amid their ongoing war of words. The post quickly drew widespread attention, leaving many asking: What triggered this now?

‘You liar': Musk was furious after Altman suggested the billionaire manipulated X's algorithm to promote his own posts and companies—just as Musk threatened Apple with legal action for allegedly boosting OpenAI on the App Store.

“You got 3M views on your bulls**t post, you liar,” Musk wrote. “Far more than I've received on many of mine, despite me having 50 times your follower count!"

Yes, and: Altman double down, challenging Musk to swear under oath that he never interfered with the algorithm. “I will apologize if so,” Altman replied.

War of bots: Adding fuel to the fire, Musk's own xAI chatbot Grok backed Altman. It cited 2023 reports saying Musk had a history of tweaking X's algorithm to serve his interests. Musk hit back by sharing a screenshot from ChatGPT claiming he's more trustworthy than Altman.

What's behind Perplexity's $34.5 billion bid for Google Chrome

Perplexity AI has stunned the tech world with an audacious $34.5 billion all-cash offer for Google's browser Chrome. It's a bold move, especially for a company valued at just $14 billion. However, it's not without reason.

Why it matters: With over 3 billion users, Chrome gives Perplexity instant access to a massive distribution channel. The timing is strategic, too: US regulators are pressuring Google to sell Chrome after a federal judge ruled it had abused its 90% search dominance. While Google is lobbying for softer remedies, the Department of Justice wants full divestment.

Between the lines: Perplexity CEO Aravind Srinivas says the offer ensures Chrome remains open-source. The company has pledged a $3 billion investment over two years, though financial details remain unclear. Still, Perplexity claims the money is ready and waiting.

What's next: A court ruling is due this month. Even if the bid doesn't succeed, it's a clear signal that Perplexity wants to muscle into AI search and is willing to go all in.

Also Read: Perplexity launches AI-powered browser to take on Google Chrome

Perplexity opens India stock and crypto data

Perplexity AI has rolled out free access to Indian stocks and crypto data via its Finance tab, offering BSE, NSE and crypto information that's usually paywalled.

Why it matters: Indian users now get historical prices, volumes, earnings, and stock screening tools – features often locked behind broker and fintech paywalls.

Details:

- Crypto data comes via Coinbase.

- Usage of Perplexity Finance has jumped 8x since launch.

- The tab joins Travel and Education in Perplexity's growing vertical suite.

ETtech Explainer: What is the new H-1B wage-based selection all about

The Trump administration has backed a key change to the H-1B visa programme: selecting applications based on salary levels instead of a random lottery.

Why it matters: This move is significant, particularly for Indian tech workers, who typically account for over 70% of the 85,000 annual H-1B visas.

Catch up: The new model favours higher-paying roles. A $213,000 Level 4 software engineer in San Francisco would now rank ahead of a $135,000 Level 1 position. That could squeeze out entry-level hires and pressure employers to boost salaries and raise costs in the process. This proposal echoes a 2021 Trump-era rule that was shelved after legal challenges.

Between the lines: Indian IT firms and US tech giants may need to rethink hiring strategies, with knock-on effects on diversity and talent planning.

What's next: USCIS will open a public comment window for up to 60 days. Final implementation could take months, but the industry is already preparing.

Want this newsletter delivered to your inbox?

I agree to receive newsletters and marketing communications via e-mail

Thank you for subscribing to Daily Top 5

We'll soon meet in your inbox.