Tata Capital, the flagship NBFC of the Tata Group, is going public. Despite adequately funded by the promoter – Tata Sons, the IPO comes on the back of the RBI-imposed, scale-based listing mandate for ‘Upper Layer’ NBFCs.

The issue, measuring ₹15,512 crore, is India’s largest IPO this year and is a mix of offer for sale (OFS) of ₹8,666 crore and fresh issue worth ₹6,846 crore. Tata Sons and a few other Tata Group entities such as Tata Investment Corporation, Tata Motors, Tata Chemicals and Tata Power together form the promoter and promoter group respectively, holding 89 per cent and 7 per cent of pre-issue share capital. Promoter Tata Sons and public shareholder International Finance Corporation (1.8 per cent pre-issue) are set to offload stake in the OFS. Post-issue, promoter and promoter group stake will become 85 per cent, with Tata Sons at 79 per cent. The fresh issue proceeds will be used to augment the Tier-I capital of the firm.

At a gross loan book of ₹2.3 lakh crore, Tata Capital is the third-largest private sector diversified NBFC, after Bajaj Finance (₹4.4 lakh crore) and Shriram Finance (₹2.7 lakh crore). With the Tata brand equity, funding has never been a hurdle, and thus, its gross loan book has grown 37 per cent between FY23 and FY25. Its debt securities are rated AAA with ‘stable’ outlook. Tata Capital is a non-deposit taking NBFC.

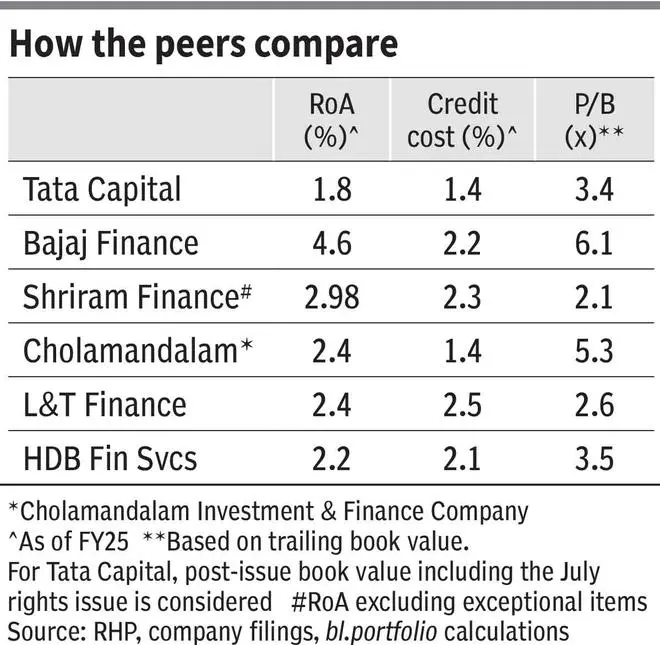

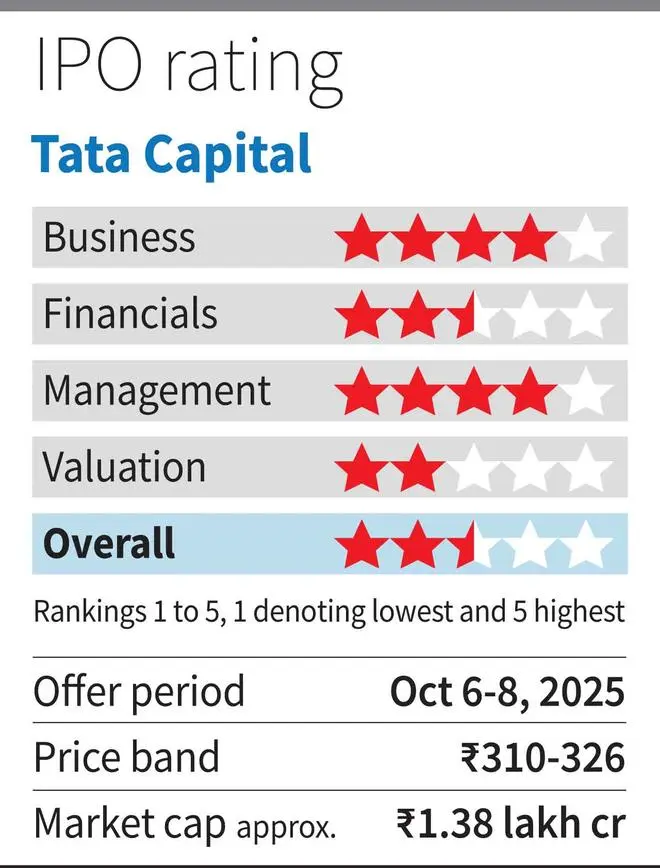

At the upper end of the price band (₹326), the issue values the company at a post-issue P/B multiple of 3.5x (based on Q1 FY26 book value). Considering the July rights issue at ₹343, the P/B works out to 3.4x. However, the issue appears to be fully priced, leaving no room for a substantial upside on listing or subsequently, especially given the company’s RoA (return on assets) of a modest 1.8 per cent (FY25). Considering the rationale which is discussed later, investors can wait and watch for better entry opportunities for now.

Business, financials

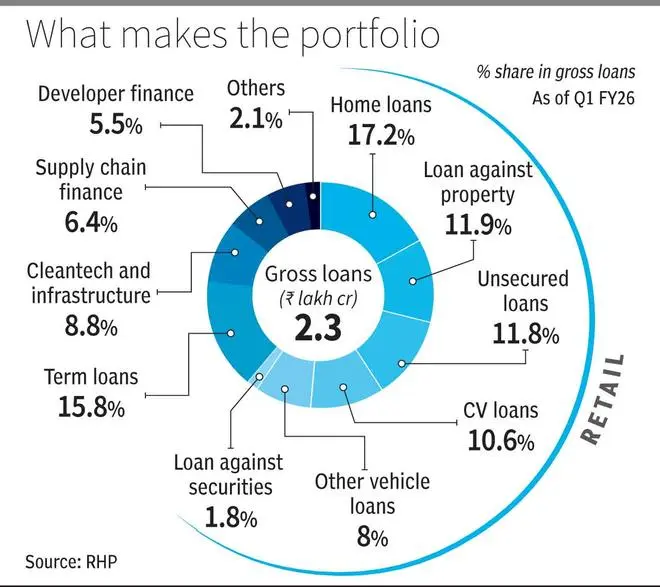

Tata Capital has two broad verticals – lending and non-lending. Under non-lending, it operates private equity and wealth management arms (AUM of about ₹7,000 crore) and also distributes insurance and credit cards. These earn fee and commission income. However, the lending vertical is key, as it accounts for about 98 per cent of total income. Under the lending vertical, the company offers a suite of products, as can be found in the pie chart. The gross loan book is split between retail, SMEs and corporate in the ratio of 61:26:13. The portfolio is also granular — 98 per cent of the portfolio has an average ticket size of under ₹1 crore. About 20 per cent of the portfolio is unsecured.

The portfolio has grown at a CAGR of 37 per cent between FY23 and FY25, 28 per cent without adding the merged loan book of Tata Motors Finance (TMFL; discussed in detail later). Profit has grown at a modest CAGR of 10 per cent and 11 per cent ex-TMFL.

TMFL merger

TMFL, which used to be a captive financing arm of Tata Motors, was merged with Tata Capital, effective April 1, 2024. Though this is the effective date, the merger consummated only in May this year, after regulatory clearances. What this means is, Tata Capital’s FY25 financials will be inclusive of those of TMFL’s, though it didn’t operate TMFL. On the effective date, TMFL’s gross loan book was ₹32,460 crore or 20 per cent of the gross loan book as of FY24 (13 per cent of FY25 merged loan book).

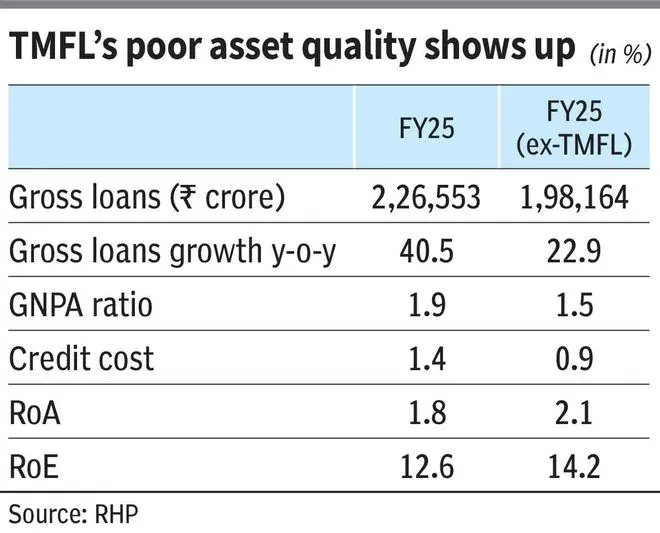

Fundamentals of TMFL (provided separately in RHP) do not inspire confidence. Gross loans have declined 7 per cent year on year in FY25 and profit of ₹52 crore in FY24 swung to a loss of 181 crore in FY25.. This, per the management, is largely because growth was put on the backburner to focus on the business integration with Tata Capital. More importantly, the asset quality of TMFL is worse than that of Tata Capital. GNPA ratio of TMFL (FY25) stood at 7.1 per cent versus Tata Capital’s (ex-TMFL) 1.5 per cent. Hence TMFL’s higher credit cost (provisions and write-offs) inflated Tata Capital’s credit cost too, in FY25 (see chart), though forming just 13 per cent of the loan book. Higher credit cost meant lower RoA for the merged entity. Even sequentially, credit cost has inched up 20 bps to 1.6 per cent, as of Q1 FY26.

Going forward too, credit cost could be elevated, as the management aligns TMFL’s provisioning policies with that of Tata Capital’s more conservative policies. Till then, RoA could be under pressure. Q1 FY26 annualised RoA stood without improvement at 1.8 per cent. The management states that the focus will be on bringing down credit cost to under 1 per cent and consequently, improve RoA to 2.2-2.4 per cent, where it has been historically. This will remain a ‘show me’ story.

Rationale

Tata Capital follows a relatively conservative strategy with respect to underwriting and products offered. This can be evidenced by a lower 20 per cent unsecured loan portfolio, versus peers such as Bajaj Finance (about 40 per cent of on-book loans). Thus, inherently Tata Capital has a lower yield on advances, compared with peers – Bajaj Finance’s 16.4 per cent, Shriram Finance’s 16.5 per cent, Cholamandalam’s 14.4 per cent and L&T Finance’s 15.2 per cent. Such peers innately have higher RoAs because of higher yields.

While there is nothing wrong with a lower yield, the idea of a conservative lending practice is to generate attractive risk-adjusted RoA by keeping credit cost down. Until asset quality and provisioning concerns at TMFL settle, the 2.2-2.4 per cent RoA target could be elusive.

The management also has plans to ramp up products which have a higher yield, such as affordable housing (currently about 6 per cent of gross loans), passenger vehicle loans and micro home loans. Again, higher yields from such products percolating into RoA could depend a lot on execution and may not happen in the near future. Repo rate cuts could aid cost of funds, but the company also has a 64 per cent floating loan book versus 45 per cent of total borrowings, based on floating rates.

Considering these, the IPO price appears to bake in the above optimistic assumptions, and the issue looks pricey for now. While the business is solid and could continue to grow at 25-30 per cent, investors can keep a close eye on credit cost, RoA trajectory and so, give the IPO a pass for now.

Published on October 5, 2025

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.